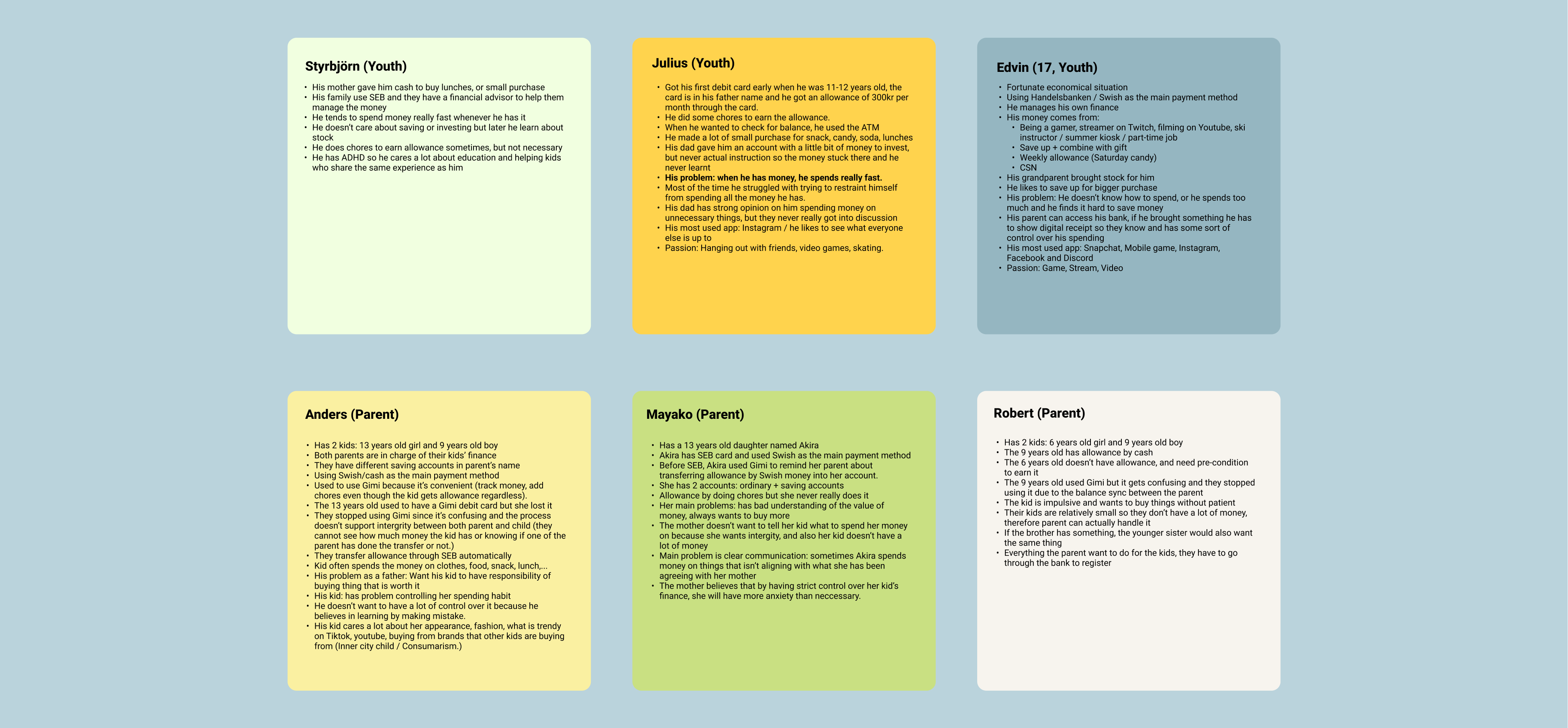

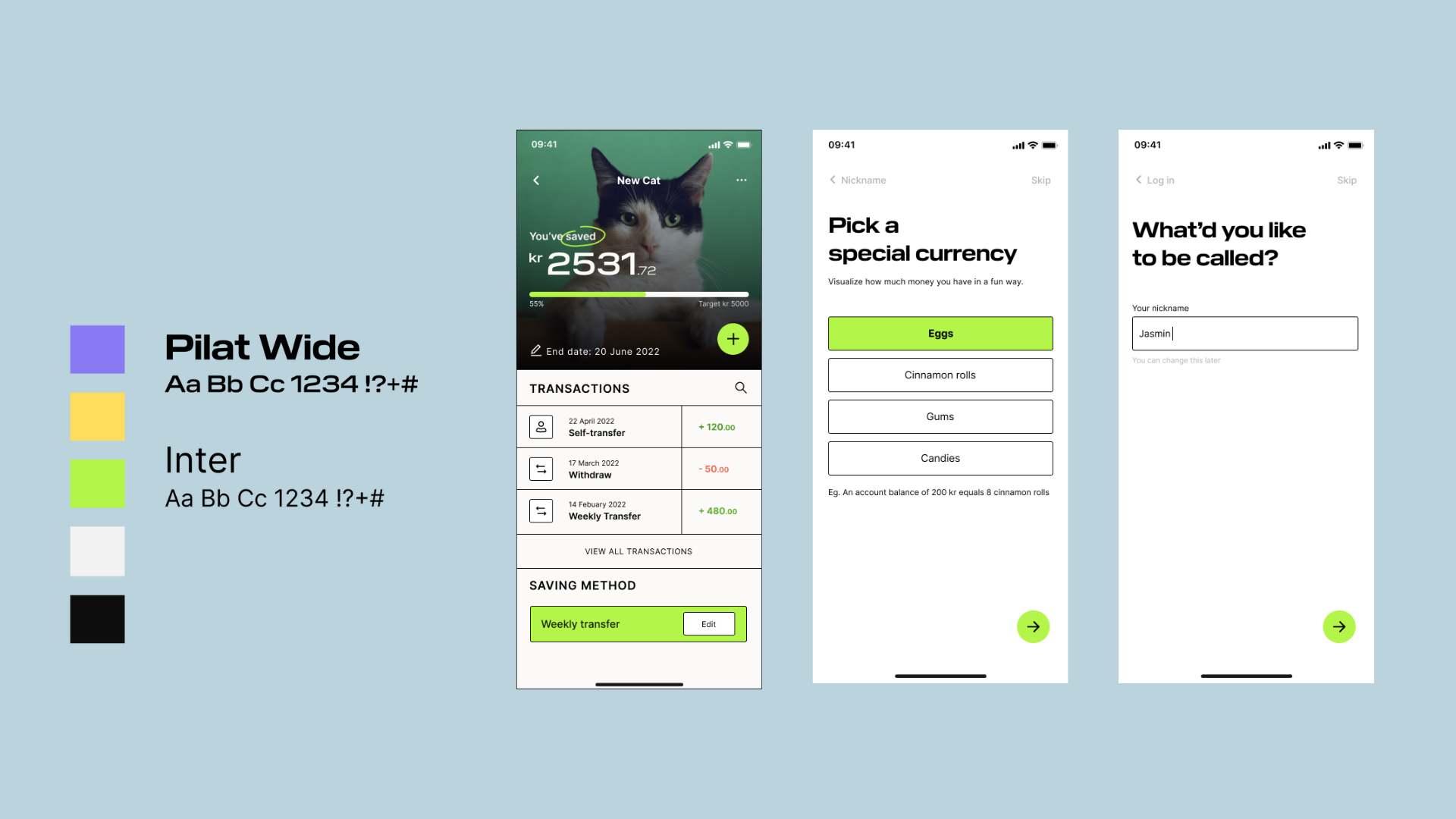

SEB Youth

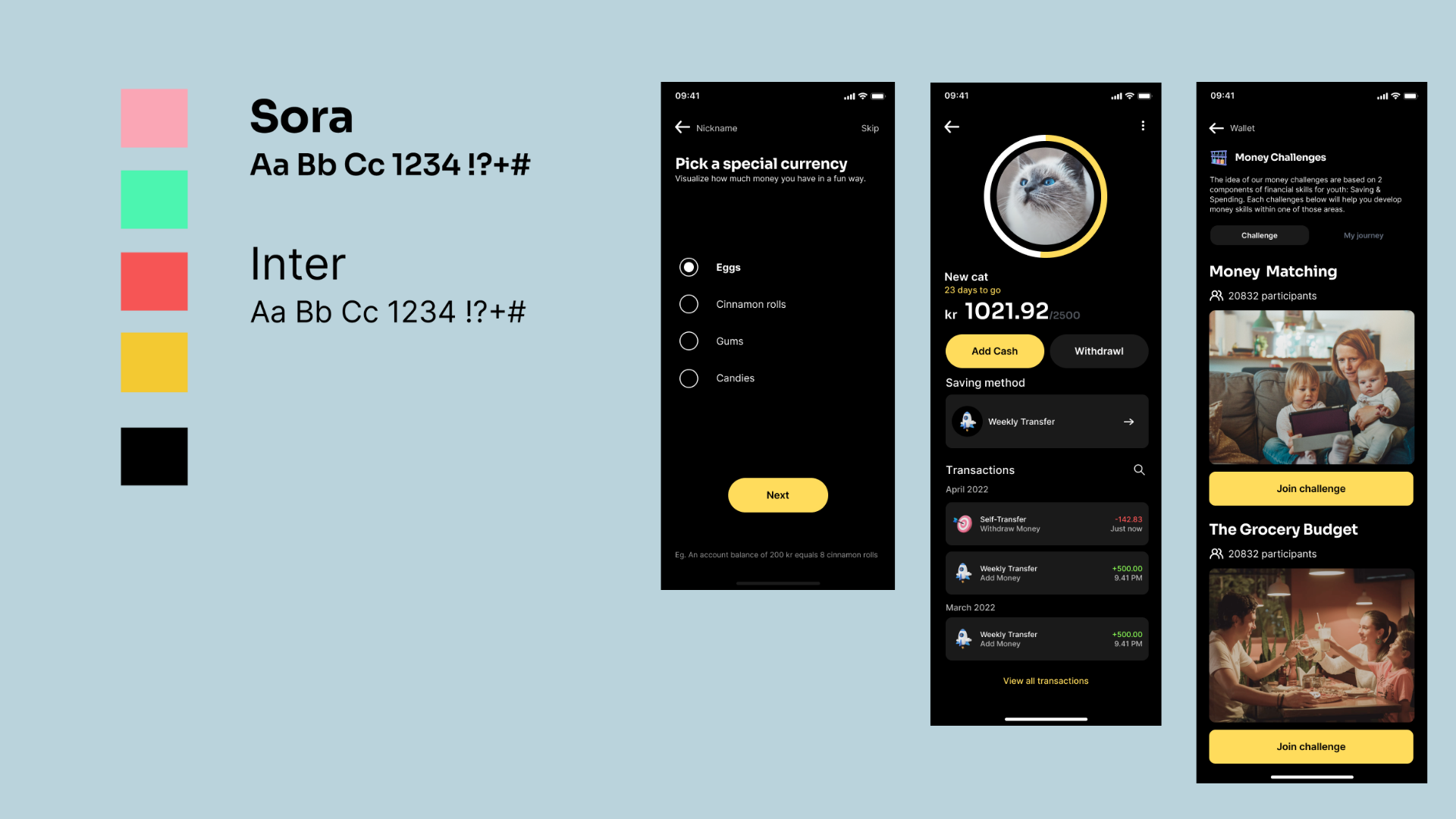

The SEB Youth app is a banking service tailored for children and teenagers. This redesign of the app was an internship project that landed me a full-time position at Bontouch.

Task

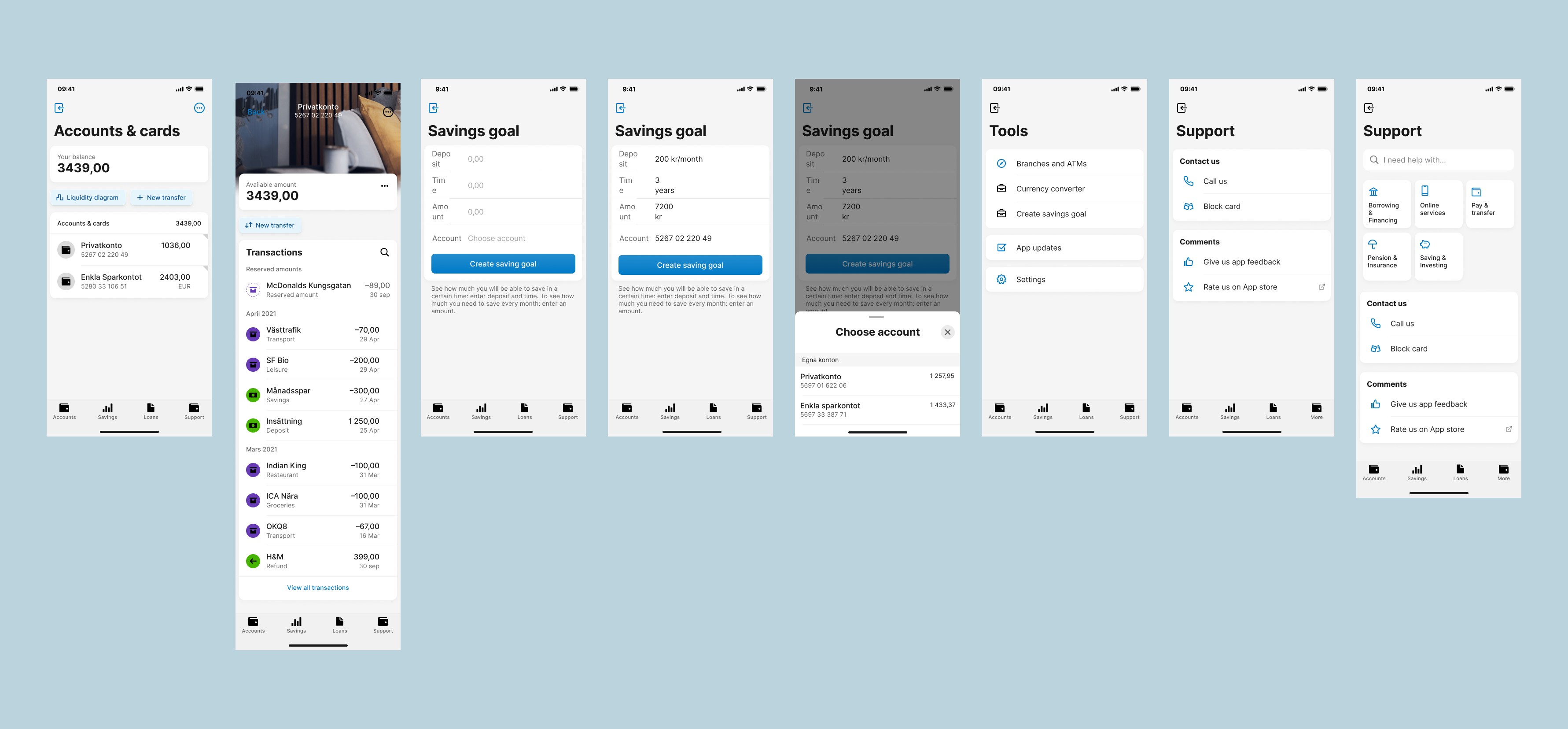

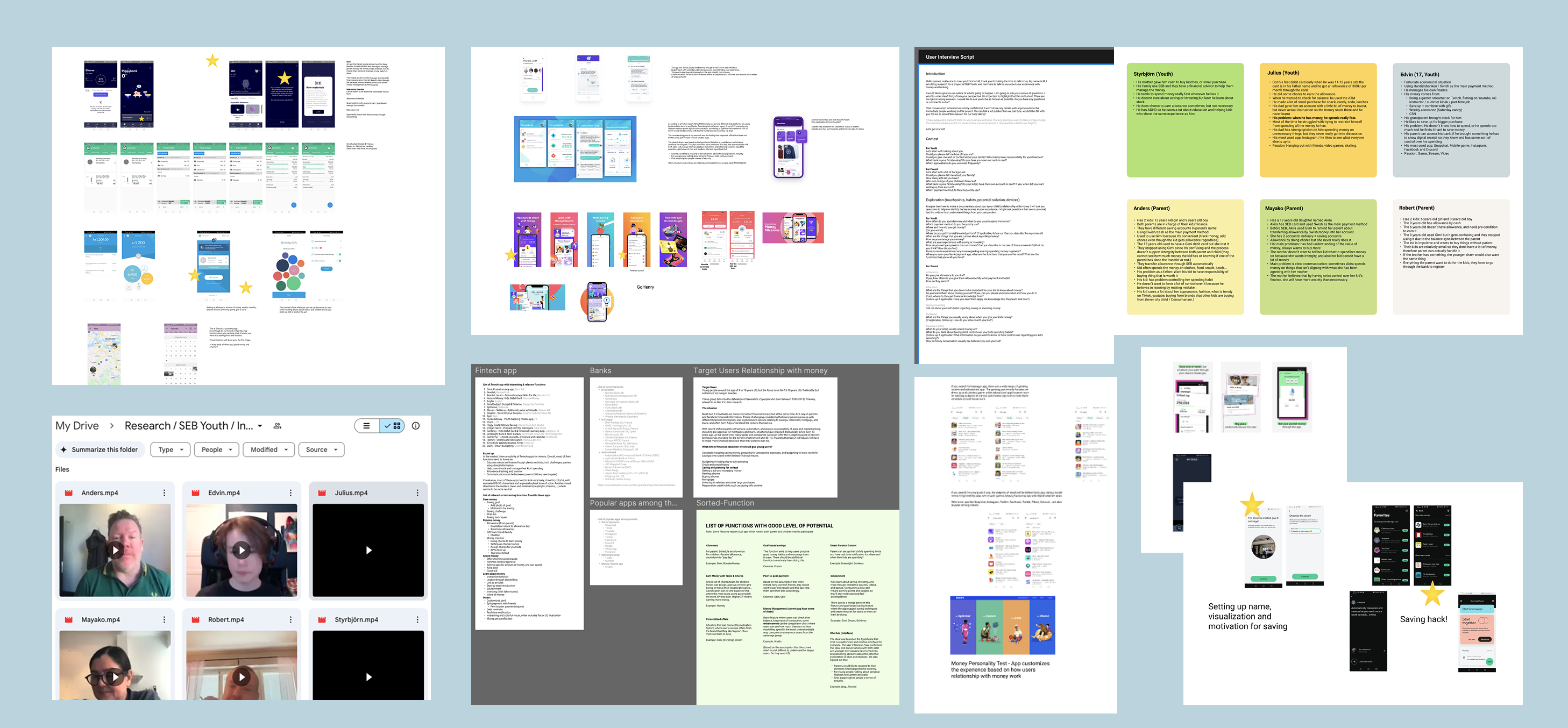

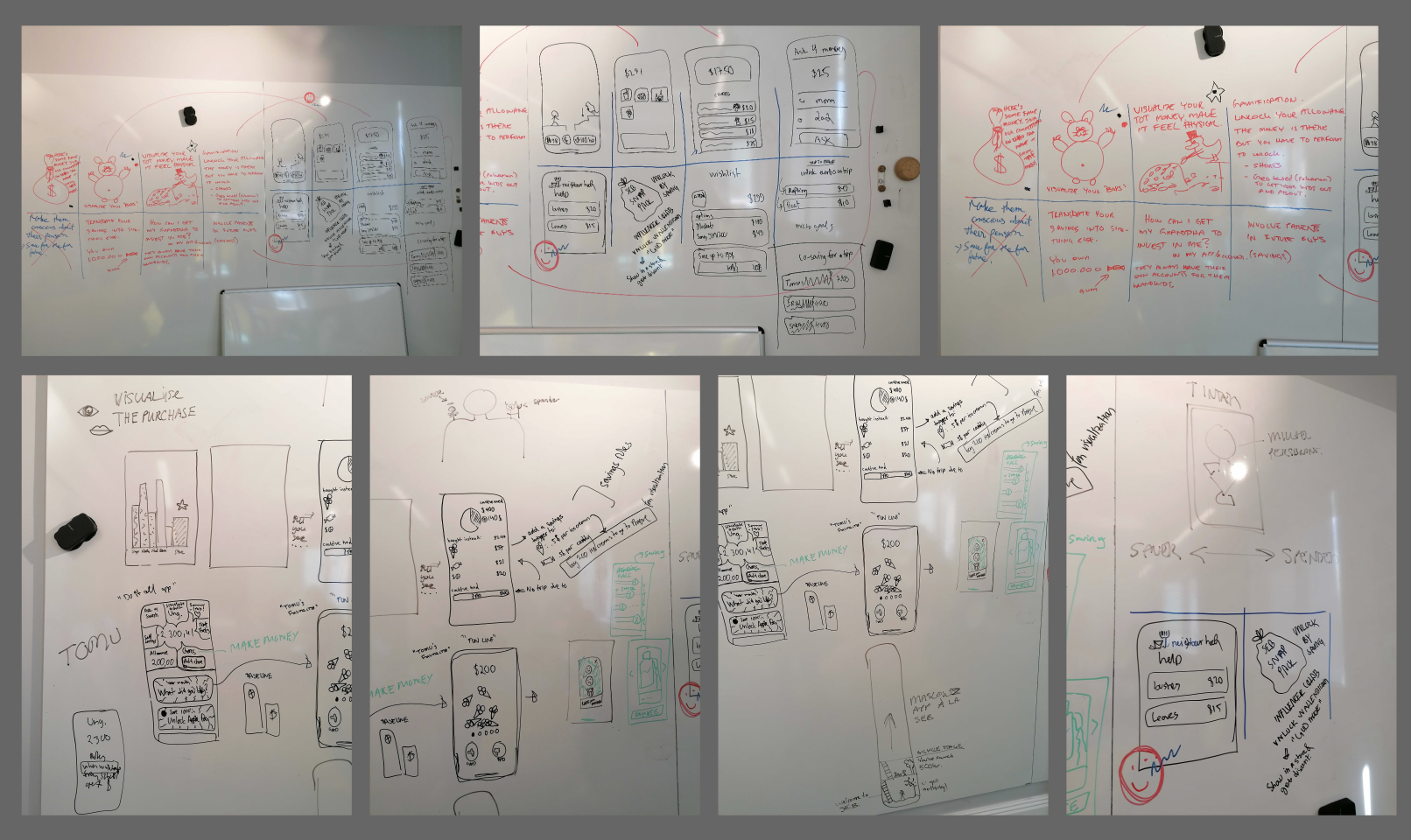

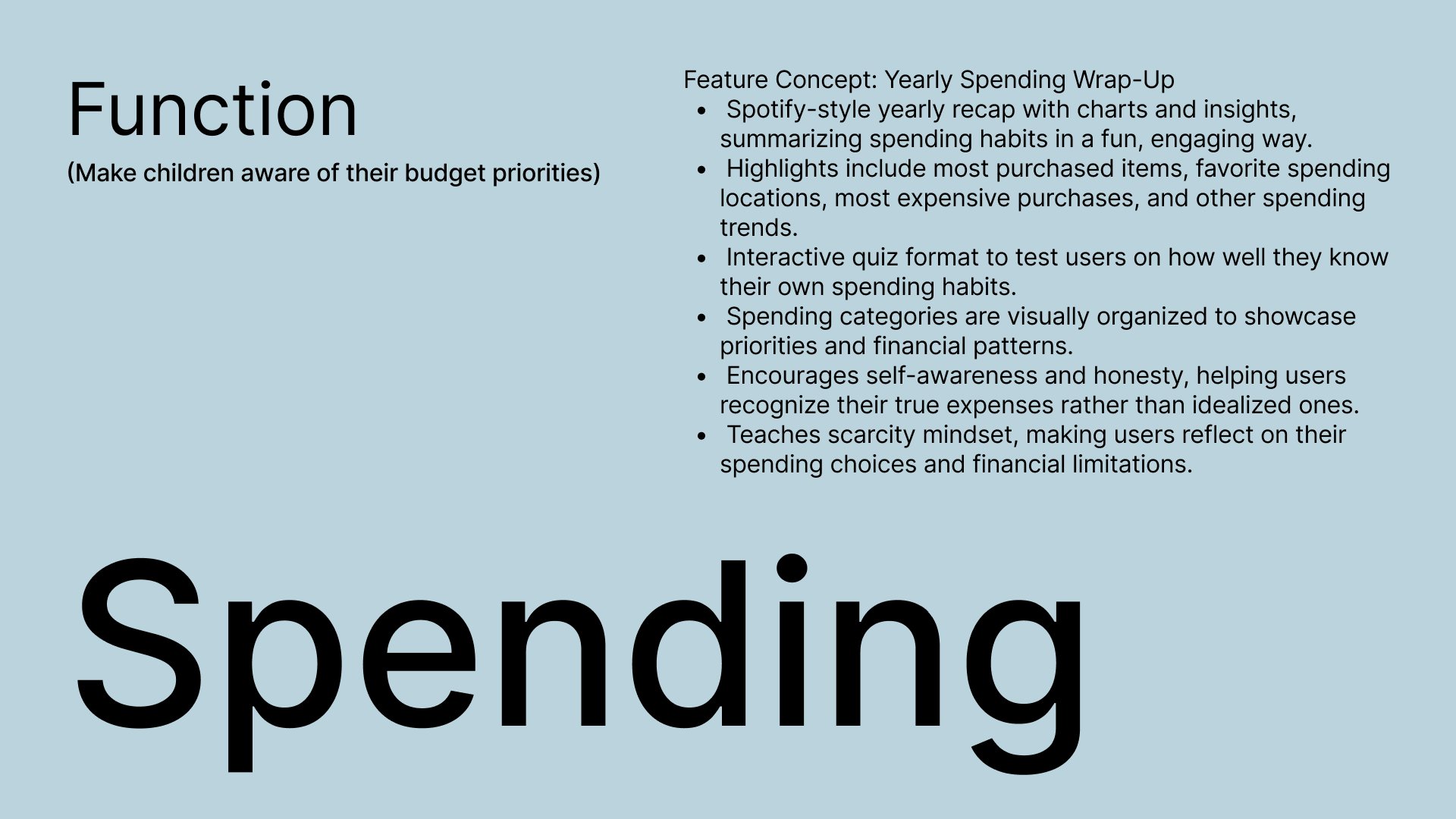

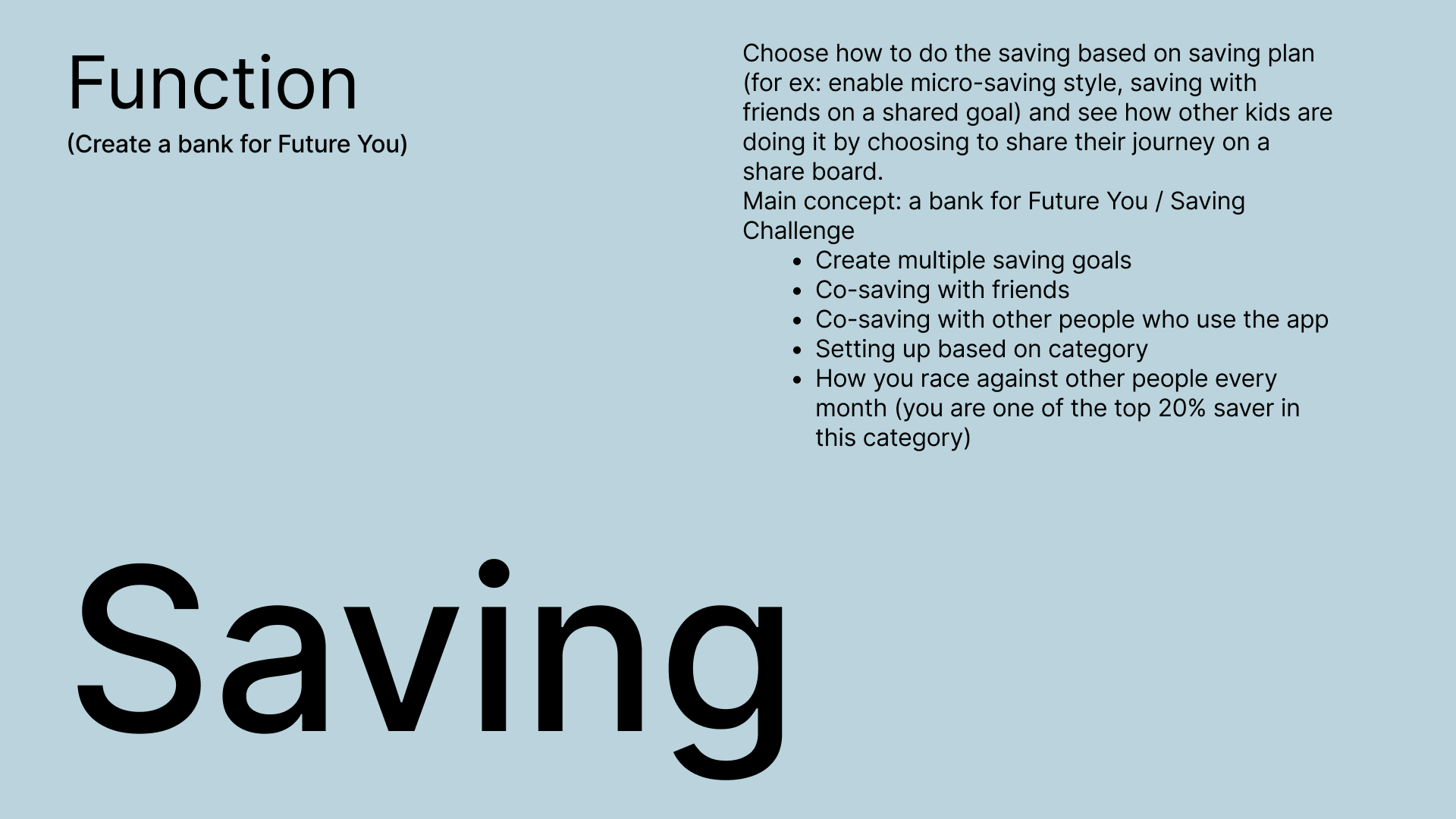

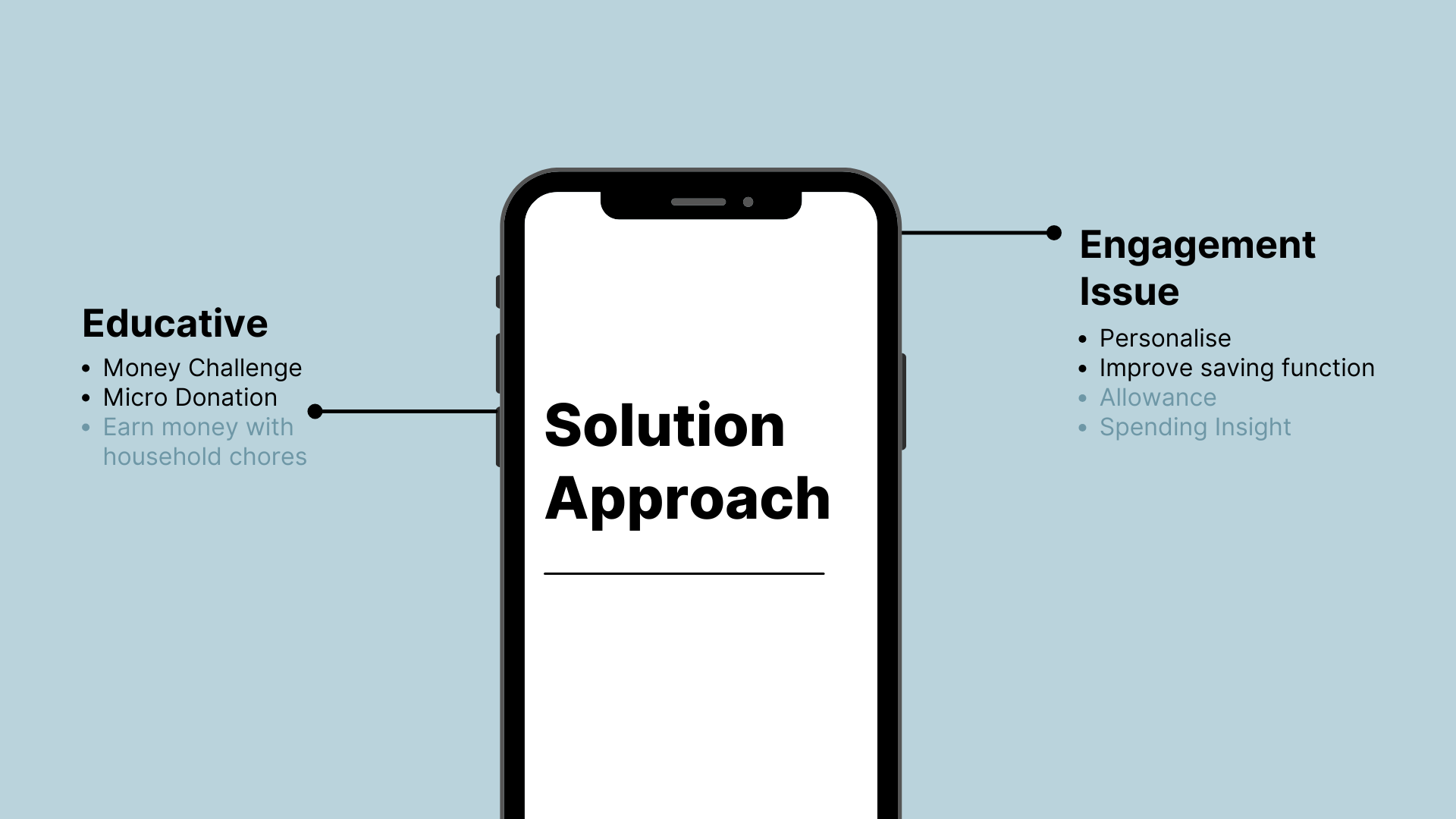

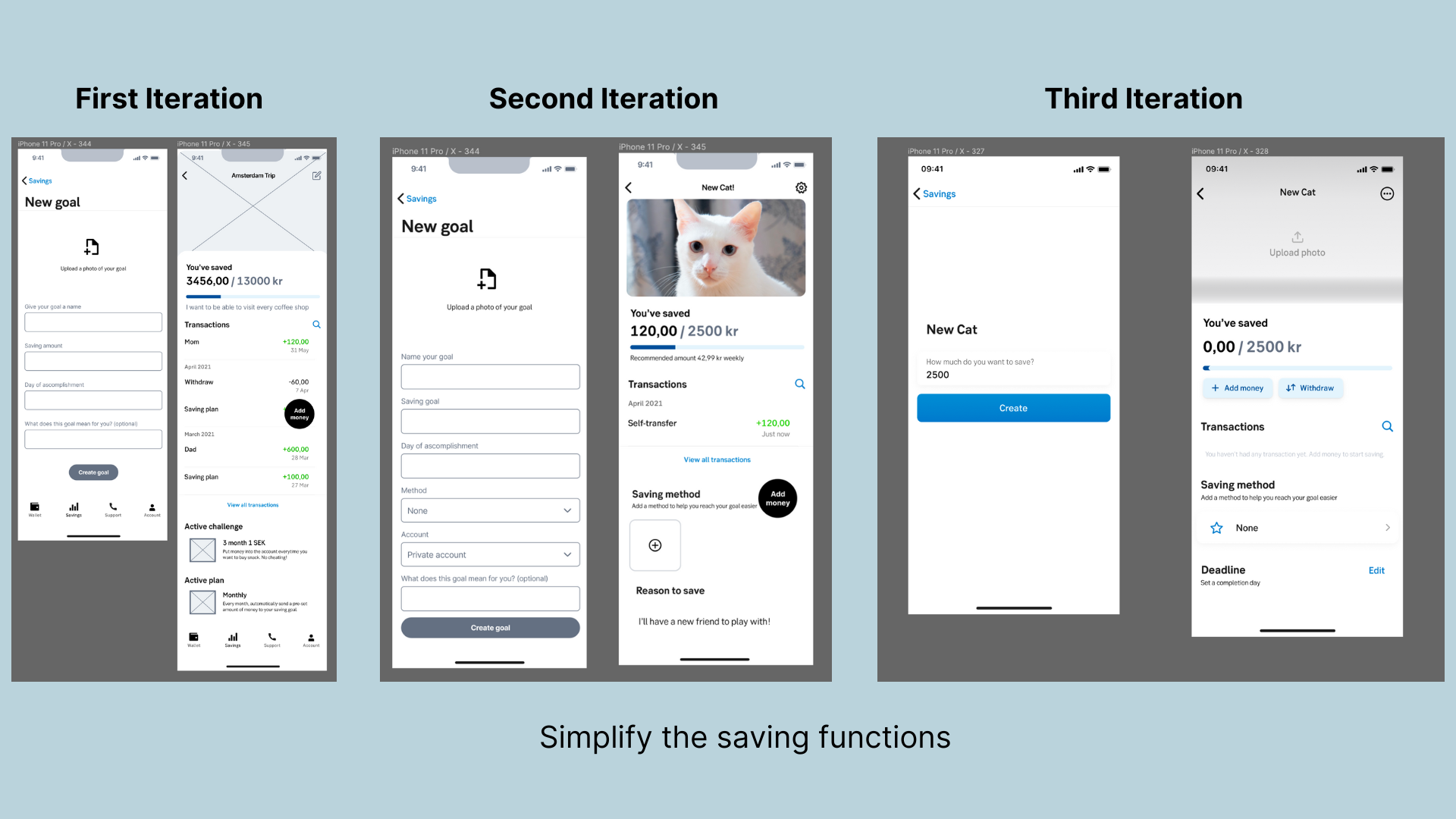

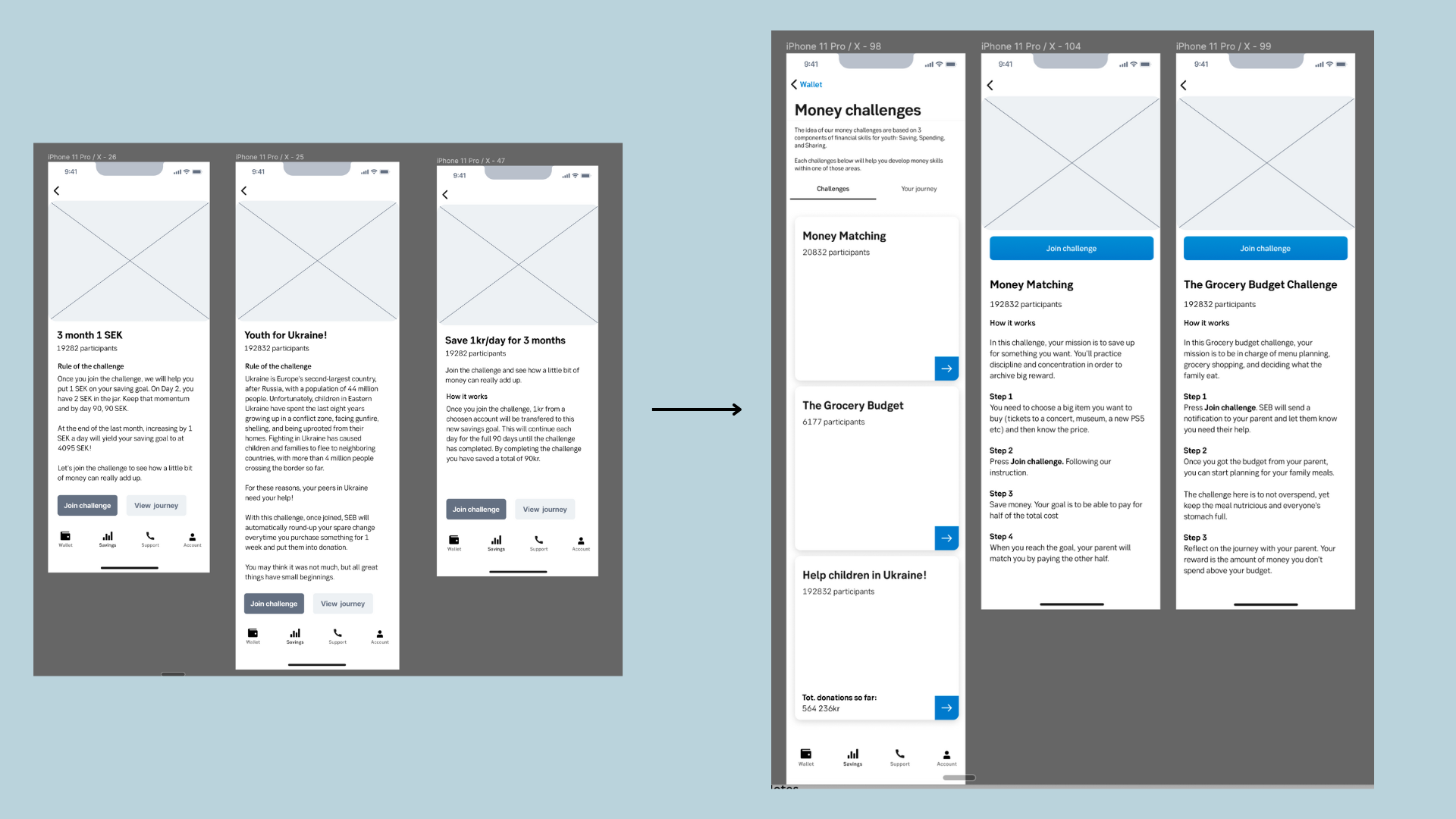

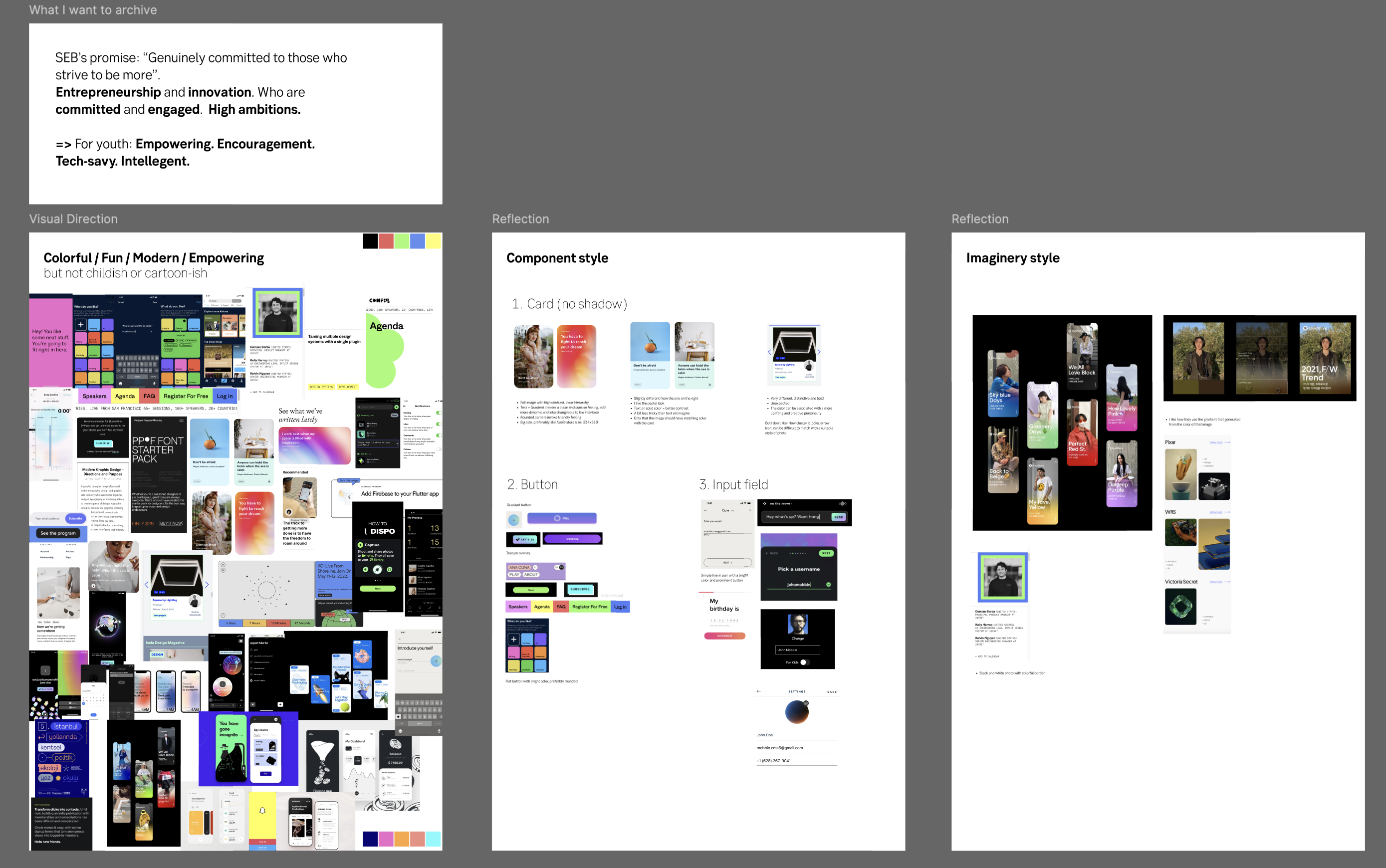

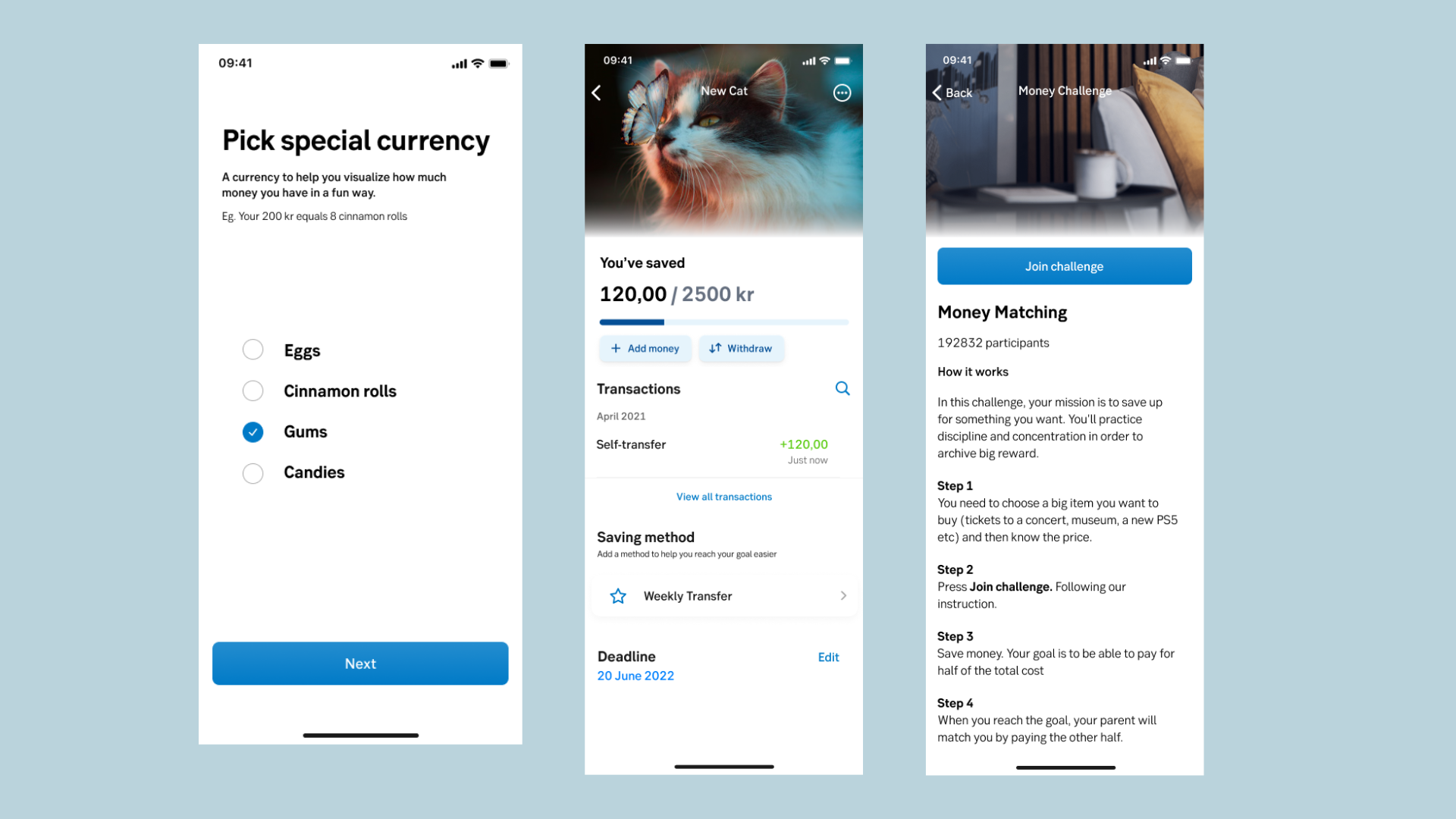

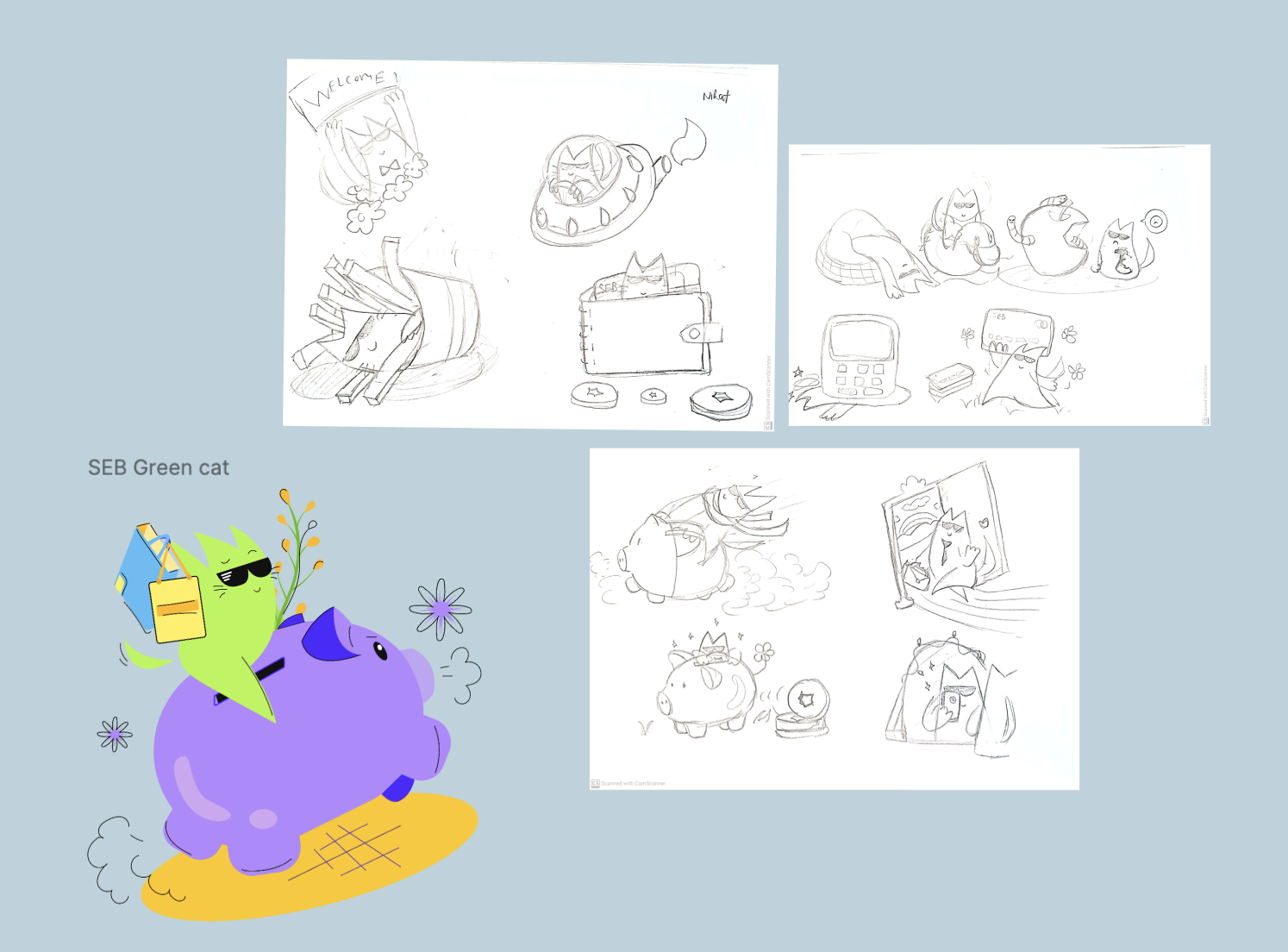

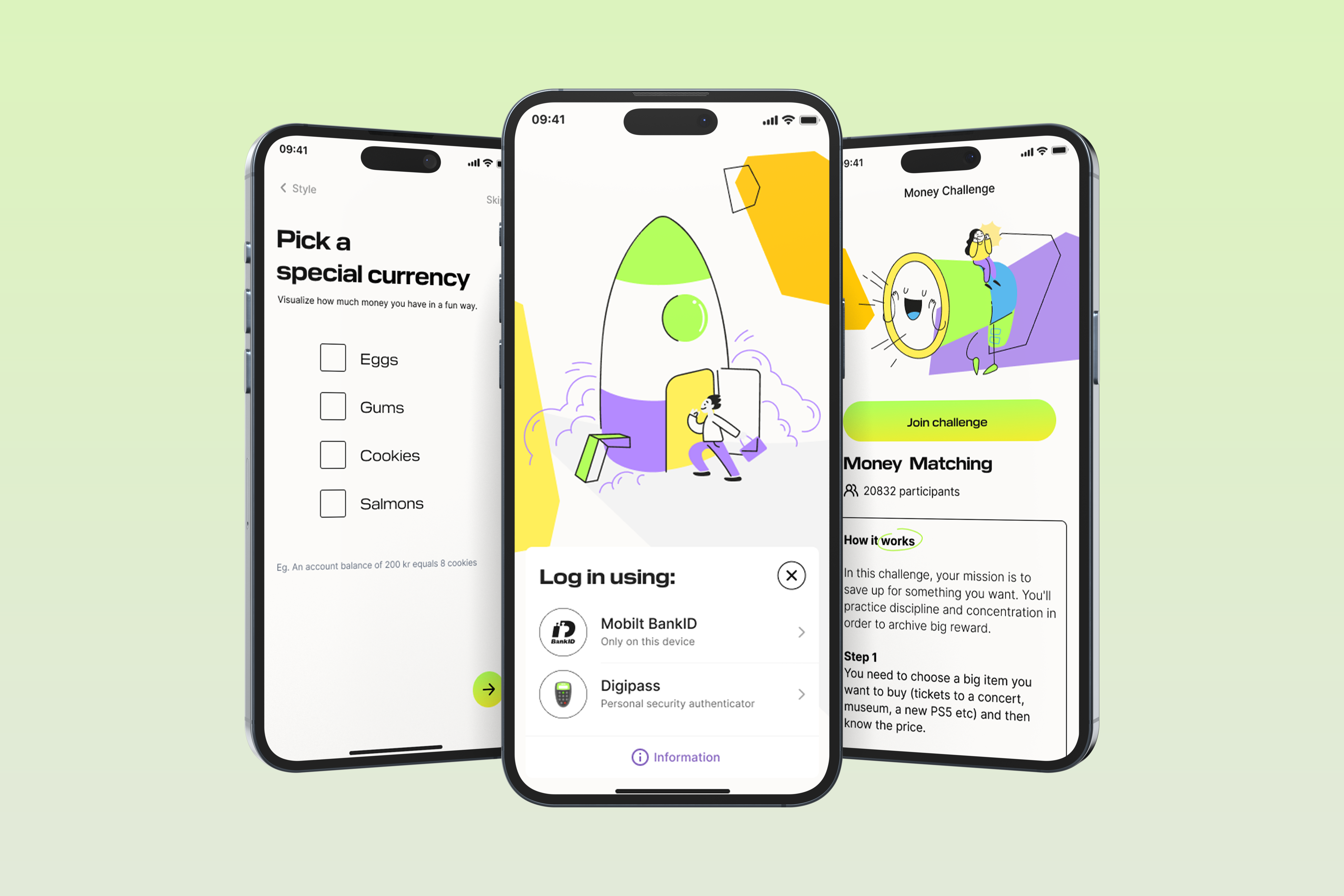

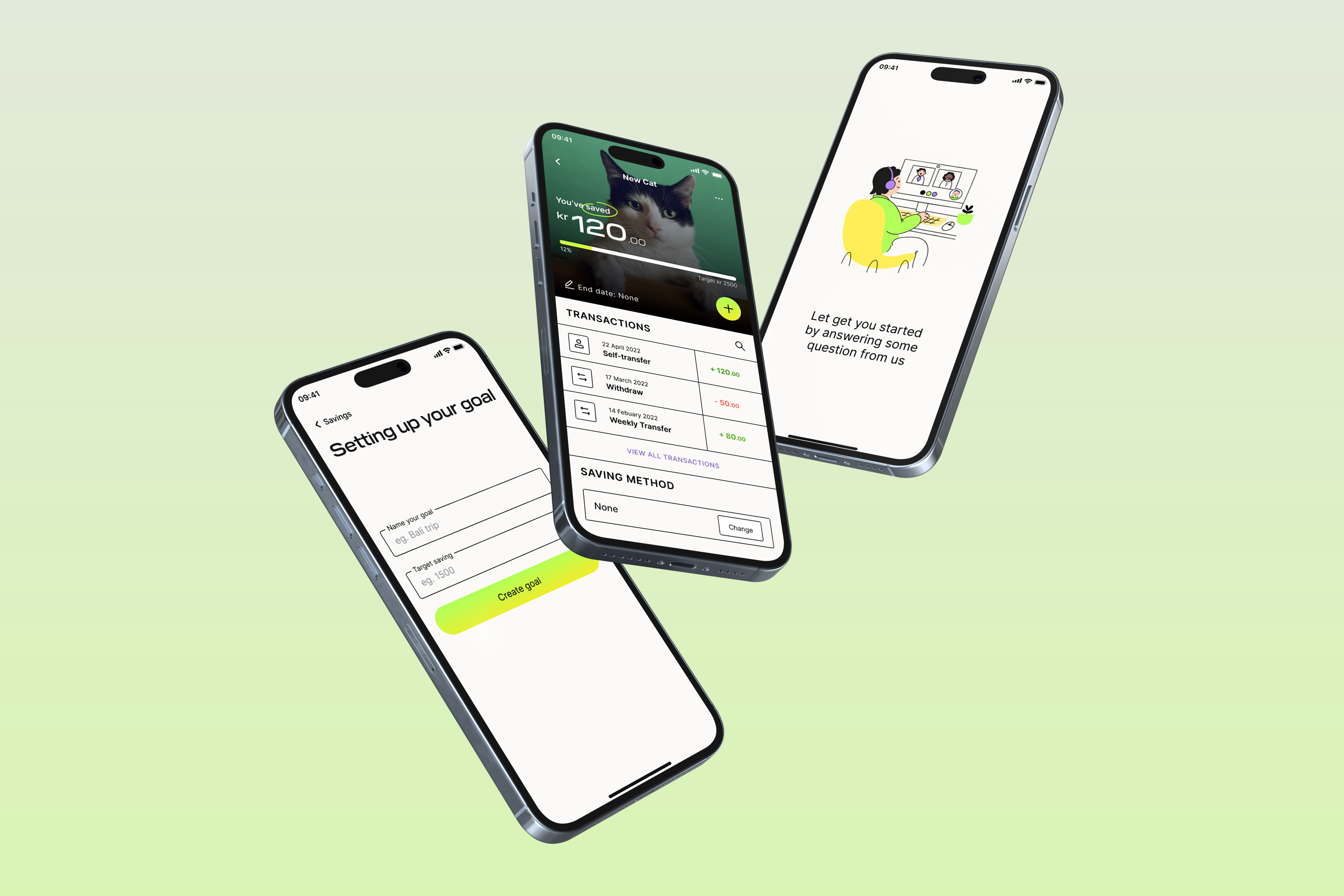

The task was to redesign and enhance the SEB Youth app by analyzing its current state, exploring innovative features, prototyping in Figma, testing with users, and collaborating with developers to create a more engaging and future-proof experience for young users.